- Tweet

- Printer Friendly

The Other Paycheck: How Off-Farm Income Keeps Farmers Farming

When most people picture a farmer, they don't envision someone teaching math, driving a school bus or managing a bank branch. Yet for the majority of U.S. farm households, income from these off-farm roles is what keeps the operation running. In 2023, just 23% of farm household income for farm families came from farming itself -- meaning a remarkable 77% came from other sources. This Market Intel explores the essential -- but often overlooked -- role of off-farm income in supporting farm families, buffering against market volatility and sustaining rural livelihoods. We also examine why public policy must recognize and support this dual-reliance model to ensure the long-term viability of U.S. agriculture.

The Role of Off-Farm Income

Off-farm income includes wages or salaries from non-farm jobs, investment returns and pension payments -- essentially any income not directly tied to producing food, fiber or fuel. In 2023, 96% of farm households (the principal operator and their spouse) earned money from off-farm sources. At the median -- the point where half of households earn more and half earn less -- farm-related income was a loss of $900. Over the past five years (2019-2023), median farm income has never exceeded just $296. In sharp contrast, median off-farm income was $79,900. Off-farm income peaked in 2021 at over $82,800 and has since declined only slightly.

This stark gap is partly due to USDA's broad definition of a farm, which includes any operation with more than $1,000 in ag product sales -- a threshold that encompasses many very small-scale or lifestyle farms not intended to provide primary income. Still, the difference highlights the vital role off-farm income plays in keeping many farm households financially afloat.

Off-farm income isn't all earned on the clock -- though most of it is. Broadly speaking, off-farm income falls into two categories: earned income, which requires work or time, and unearned income, which comes from passive sources or public transfers. The majority -- about 72% of off-farm income in recent years -- has come from earned sources, including wages and salaries (61%) and nonfarm business income (11%). The remaining 28% has come from "unearned" sources like Social Security, veterans' benefits, pensions, dividends and interest. These passive income streams, while smaller overall, can still play a stabilizing role -- especially for older retired or semi-retired farmers no longer relying on wages.

Who's Earning Off-Farm Income

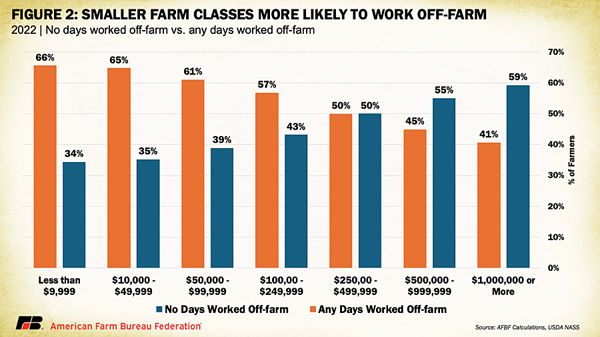

The smaller the farm--measured by gross cash farm income which includes agricultural sales and government payments--the more dependent it tends to be on off-farm employment. Among farms with less than $100,000 in annual gross sales, over 60% of principal operators worked at least one day off the farm. In contrast, that figure drops to 45% or less for farms with over $500,000 in gross sales. This pattern makes intuitive sense: smaller farms often don't generate enough revenue to cover basic household expenses, let alone reinvest in the business. Off-farm jobs become essential to bridge the gap--helping pay for housing, healthcare, education and retirement.

On the flip side, larger farms typically require full-time attention and labor from operators, making off-farm work less feasible. Still, across all farm sizes, a notable share of producers rely on income from beyond the farm gate. This diversification helps stabilize household finances--especially in years when farm income dips into the red.

Just as smaller farms are more reliant on off-farm income, so too are young and beginning farmers. Defined as individuals 35 years or younger, or those with fewer than 10 years of farming experience, respectively, these groups are more likely to hold off-farm jobs. In fact, only about 20% of young farmers and 24% of beginning farmers reported working exclusively on the farm -- compared to nearly 40% of all farmers.

This trend reflects the steep financial climb facing new entrants to agriculture. Without inherited land, equipment or equity, it's difficult to rely solely on early farm earnings. Off-farm jobs help cover startup costs and personal expenses and provide access to health insurance and other benefits. Just as importantly, these roles offer opportunities to build credit, acquire valuable skills and develop professional networks that can support long-term success in farming.

By Daniel Munch, Economist, American Farm Bureau Federation