- Tweet

- Printer Friendly

Rethinking Basis Behavior in a High-Price Cattle Market

When we reach either extreme of the cattle cycle, it changes how we interpret and forecast price relationships. One challenge is understanding relative prices for cattle in different weight classes and basis, particularly when traditional models rely on historical averages. This article focuses on the role of the cattle cycle, the changing relationship between calf and feeder cattle prices, and the implications for basis.

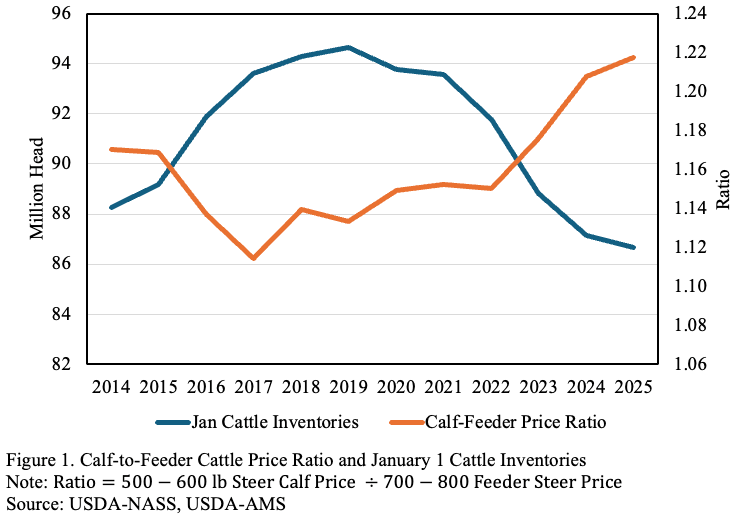

Figure 1 shows the annual average ratio of Arkansas calf to feeder cattle prices with national January 1 cattle inventories. Tight calf supplies following herd contraction raise the relative value of calves, shown by an increase in the price ratio. This shift in price relationships not only has implication for margins—it also impacts how we interpret and predict basis patterns.We forecast basis instead of price because cash and futures prices tend to move together. The futures market already forms expectations about the overall price level, so we focus on forecasting the difference between the local cash price and the futures price. That difference is called basis and the formula for calculating it is: Basis = Cash Price – Futures Price and can be positive or negative. To forecast a cash price, we use: Cash Price = Futures Price + Expected Basis. For example, if we want to forecast the Arkansas cash price for November 2025, we would use the most recent price for the November 2025 Feeder Cattle futures contract and add a forecast for November feeder cattle basis for a specific class of cattle in Arkansas.

This approach allows us to anchor our local price expectations to the futures market, which reflects broader supply and demand fundamentals. Forecasting basis is more manageable because it tends to be more stable. Research finds that using a 3- to 5-year historical average is the superior method for forecasting basis. However, during periods of extreme herd liquidation or expansion, historical averages may not work well.

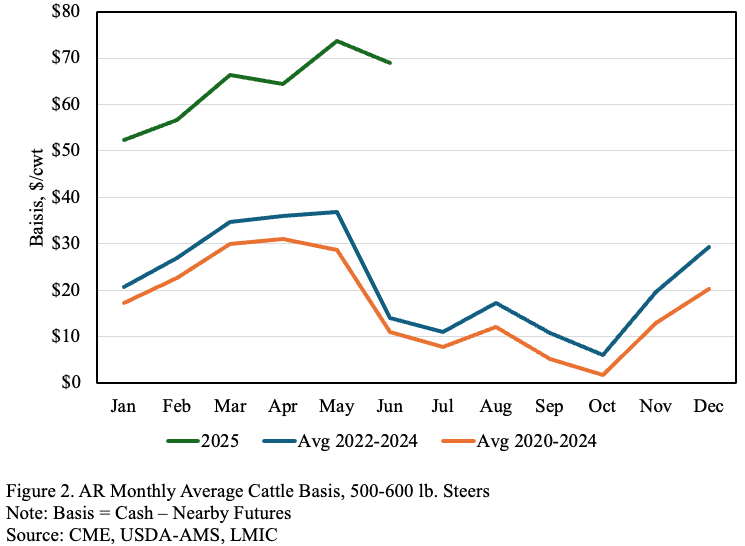

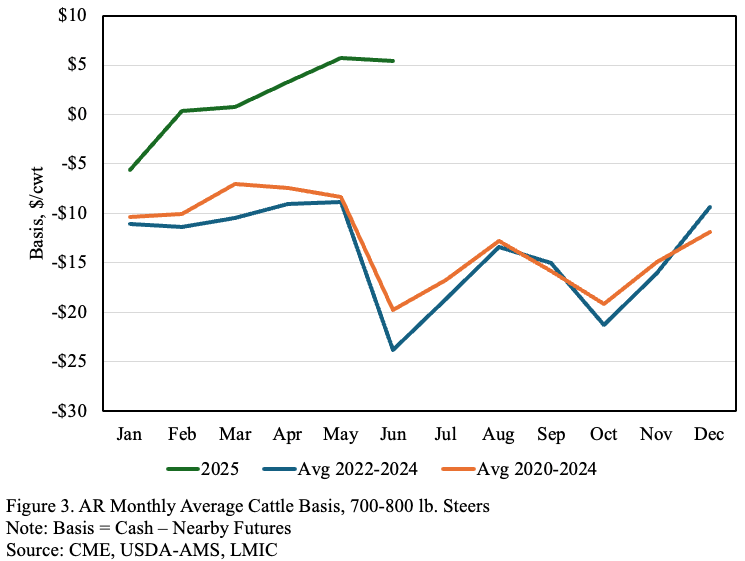

Figures 2 and 3 plot historical monthly average basis for 500-600 lb and 700-800 lb steers in Arkansas, respectively. Each weight class exhibits distinct basis behavior, with lighter-weight calves typically having stronger and more variable basis than heavier feeders. For both classes of cattle, there is a sharp divergence between 2025 basis and the 3- and 5-year historical averages. This divergence is especially pronounced for calves, where basis is much stronger (more positive) than historical norms. Relying on historical basis to forecast 2025 prices would result in a major error—large enough that it would be obvious in hindsight.

Even with strong prices, producers still have to buy and sell cattle, and margins remain critical. As cattle prices continue to sit at historic levels and herd contraction changes price relationships, traditional tools like historical basis forecasts require careful interpretation. Forecasting errors become more expensive in a high-price environment. In this setting, one alternative is to rely on seasonal price relationships which tend to be more stable now that the market has transitioned into a high-price environment and consider adjustments to basis forecasts that reflect current cattle cycle dynamics and relative price changes between calves and feeders.

Source: James Mitchell, Livestock Marketing Specialist, University of Arkansas