- Tweet

- Printer Friendly

Farm Credit Associations Release Benchmark Farmland Values Report

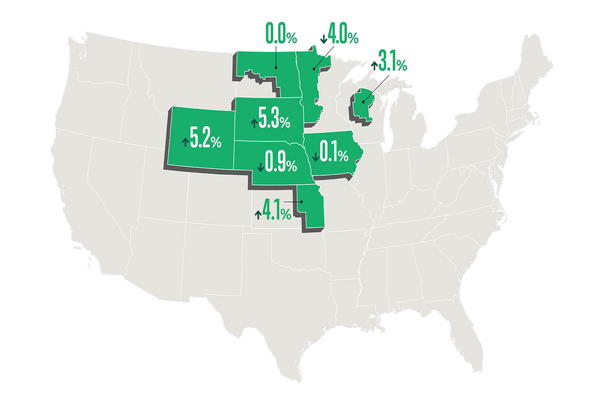

OMAHA, Neb. - Farmland values continue to show stability across Iowa, Kansas, Minnesota, Nebraska, North Dakota, South Dakota, Wisconsin and Wyoming, the eight states served by AgCountry Farm Credit Services (AgCountry), Farm Credit Services of America (FCSAmerica) and Frontier Farm Credit. Steady values amid market uncertainty point to the financial strength in agriculture.

As a whole, values ticked up 1.10% in the first six months of 2025, with changes for individual states ranging from -4.00% to 5.30%. The 12-month value changes ranged from -3.00% to 11.50% with an average of 2.10%. The major factors affecting the agricultural real estate market are lower commodity prices, profitability in the cattle market, and limited supply of real estate for sale, which continues to be consistent over the past reporting periods. Farmers and ranchers also continue to be the predominant buyers.

According to Tim Koch, executive vice president of business development for FCSAmerica and Frontier Farm Credit, the report indicates a balanced market with steady demand and a normal volume of sales activity. "All in all, the overall strength of the agricultural financial position is still very, very strong," Koch said. "We can't get lost in the noise - real estate values cut through all that and show the real picture of what's going on in agriculture."

He went on to explain that unlike short-term commodity price swings or isolated financial stress, land values reflect long-term confidence. "When producers are still willing to invest in farmland, it tells us they believe in the future of the industry. That kind of stability is a grounded, tangible signal of where agriculture really stands."

Mark Vetter, vice president business development for AgCountry, said specifically in AgCountry's footprint that the market has remained stronger than expected, referencing that values are mostly flat only because its holding at some record highs. "One contributing factor is that multi-generational farms continue showing up at auctions, looking to convert rented acres into owned land. That steady, competitive demand is what's kept the market durable, even in the face of higher interest rates and lower commodity prices."

Vetter explained that this trend is driven by a strategic shift among producers, "Families are looking to reduce their exposure to the cash rent market, which can carry increasing risk. In our region, cash rents are still lower than in places like Iowa or Nebraska, but yields aren't far behind - so there's a clear incentive to lock in ownership now. Many farms are trying to get ahead of future rent increases by securing land while they can."

State-by-State Cropland and Pastureland Benchmarks Cropland Benchmarks

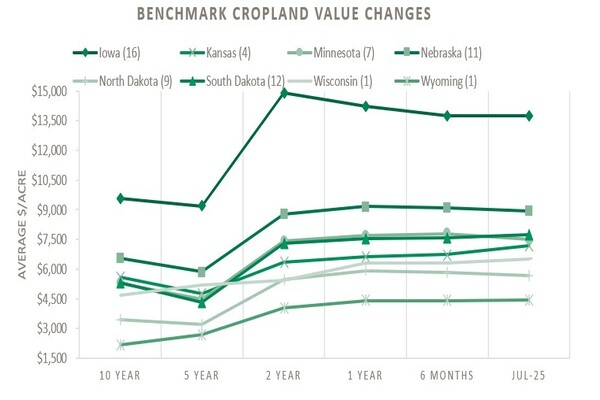

Average value trends of the 61 predominantly cropland benchmark farms:

Iowa cropland benchmark values decreased -0.10% over the past 6 months and -3.60% over the past 12 months.

Kansas cropland benchmark values have increased 5.60% over the most recent 6-month period, and by 7.30% over the past year.

Six Minnesota cropland benchmarks showed some fluctuations but averaged a -2.80% decrease over the past 6 months and a decrease of -1.40% over the past 12 months.

Nebraska cropland benchmark values over the last 6 months decreased -0.50% and -1.20% over the last 12 months.

North Dakota cropland benchmark values had a -0.90% decrease over the past 6 months and no change over 12 months.

South Dakota cropland benchmark values increased 3.50% over the past 6 months and 6.20% over the past year.

The Wisconsin cropland benchmark had an increase of 3.10% over the past 6 months and 12 months, respectively.

The Wyoming cropland benchmark was relatively stable over the past 6 months and increased 0.50% over the past year.

Pasture/Ranch Benchmarks

Highlights of the 12 predominantly pasture benchmark farms:

The three Kansas pasture benchmarks increased an average of 2.20% over the past 6 months and 1.50% over the past 12 months.

Nebraska pasture benchmark values decreased slightly over the past 6- and 12-month marks averaging at -1.00% decrease. Nebraska has two puritan pasture benchmarks, an upland pasture farm in central Nebraska and a Sandhills ranch.

The North Dakota pasture benchmark increased 8.10% over the past 6 and 12 months.

The five South Dakota pasture benchmarks showed an increase of 14.20% over the past 6 months and 26.2% over the past 12 months. The state of South Dakota showed the greatest strength in pasture values across the Associations this reporting period. The increase is largely due to limited sales data in the western part of the state over the past 12 months, the spring of 2025 has been active with new data to analyze. The availability of land (pasture specifically) along with the strong cattle market has contributed to the sales activity.

The Wyoming pasture benchmark value increased 9.90% over the past 6 months and 12 month periods, respectively.

Iowa, Minnesota, and Wisconsin do not have pasture benchmark farms.

About AgCountry Farm Credit Services

AgCountry Farm Credit Services is a member-owned financial services cooperative committed to serving rural communities and agriculture. With offices in agricultural communities across North Dakota, Minnesota, and Wisconsin, AgCountry offers a full suite of financial services, from traditional farm loans to financial planning services. Learn more at AgCountry. For more information, visit agcountry.com.

About Farm Credit Services of America

Farm Credit Services of America is a customer-owned financial cooperative proud to finance the growth of rural America, including the special needs of young and beginning producers. With more than $47.6 billion in assets and nearly $8 billion in members equity, FCSAmerica is one of the region's leading providers of credit and insurance services to farmers, ranchers, agribusiness and rural residents in Iowa, Nebraska, South Dakota and Wyoming. Learn more at fcsamerica.com.

About Frontier Farm Credit

Frontier Farm Credit in eastern Kansas is a customer-owned financial cooperative proud to finance the growth of rural America, including the special needs of young and beginning producers. The Association has nearly $3.5 billion in assets and nearly $610.2 million. Learn more at frontierfarmcredit.com.